Table of Contents

Understanding House Loan Repayment

What is Loan Repayment?

House Loan repayment calculator refers to the process of repaying the borrowed funds, including both the principal amount and the interest accrued, over a specified period. For house loans, repayment typically occurs through Equated Monthly Installments (EMIs) over the loan term, which can range from 15 to 30 years.

Components of Loan Repayment

Loan repayment consists of two main components:

- Principal: The amount bighomeimprovement.com/ from the lender, which must be repaid over the loan term.

- Interest: The cost of borrowing money, calculated as a percentage of the outstanding loan balance and added to each repayment installment.

How to Use a House Loan Repayment Calculator

Using a house loan repayment calculator is straightforward. Follow these steps to estimate your loan repayment schedule:

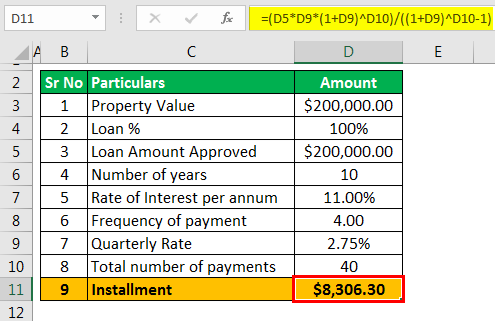

- Enter Loan Details: Input the loan amount, interest rate, loan term, and start date into the repayment calculator. The loan amount is the total amount borrowed, the interest rate is the annual interest charged by the lender, the loan term is the duration of the loan in years, and the start date is the date the loan begins.

- Calculate Repayment Schedule: Once you’ve entered the loan details, click the “Calculate” button to generate the loan repayment schedule. The calculator will display a detailed schedule of monthly payments, including the principal and interest components, for the entire loan term.

- Review Results: Review the repayment schedule to understand how your monthly payments are allocated between principal and interest and how the loan balance decreases over time. Pay attention to the total interest paid over the loan term to assess the overall cost of borrowing.

Benefits of Using a House Loan Repayment Calculator

- Financial Planning: Repayment calculators help borrowers plan their finances by estimating their monthly loan payments and total interest costs.

- Comparison: By adjusting loan details, borrowers can compare different loan options and scenarios to find the most affordable repayment plan.

- Transparency: Repayment calculators provide transparency into the loan repayment process, helping borrowers understand how their payments are applied and how the loan balance changes over time.

Conclusion

A house loan repayment calculator is a valuable tool that enables borrowers to estimate their loan repayment schedule and make informed decisions about their finances. By understanding how to use a repayment calculator and reviewing the repayment schedule, borrowers can plan their loan repayment effectively and manage their finances responsibly throughout the loan term.

In conclusion, utilizing a house loan repayment calculator empowers borrowers to estimate their loan repayment schedule accurately and plan their finances effectively over the loan term.